Original Medicare (having only Part A and Part B) allows you to see any doctor or hospital that simply accepts Medicare in the U.S. and its territories which includes all 50 states, the District of Columbia, Puerto Rico, Guam, the Virgin Islands, American Samoa, and The Northern Mariana Islands. You will find that most doctors and hospitals do accept Medicare. It is always a good idea to double check that the doctor or hospital you go to will file with Medicare.

Foreign Travel with Original Medicare

Medicare health coverage outside the U.S. is limited to only a few situations that are listed below. Medicare may pay for inpatient hospital, doctor, ambulance services, or dialysis you receive in a foreign country:

- If you are in the U.S. when a medical emergency occurs and the closest hospital to get to is a foreign hospital.

- If you are traveling through Canada without unreasonable delay by the most direct route between Alaska and another U.S. state, and nearest hospital is in Canada that can treat the medical emergency. Medicare determines what an “unreasonable delay” is on a case by case basis.

- If you live in the U.S. and a foreign hospital is closer to your home than the nearest U.S. hospital. In this situation you can receive any Medicare approved medical treatment, regardless if an emergency exists.

Also, if you needed medically necessary services that you get on board a cruise ship within the territorial waters adjoining the land areas of the U.S. Specifically, this means that a ship is in a U.S. port or within 6 hours of arrival at or departure from a U.S. Port.

If one of these rare situations above applies to you it is also important to know that foreign hospitals are not required to file Medicare claims. You would need to submit an itemized bill to Medicare. To find claim forms see: https://www.medicare.gov/claims-appeals/how-do-i-file-a-claim.

How does a Medicare Supplement (Medigap) Plan work if I travel?

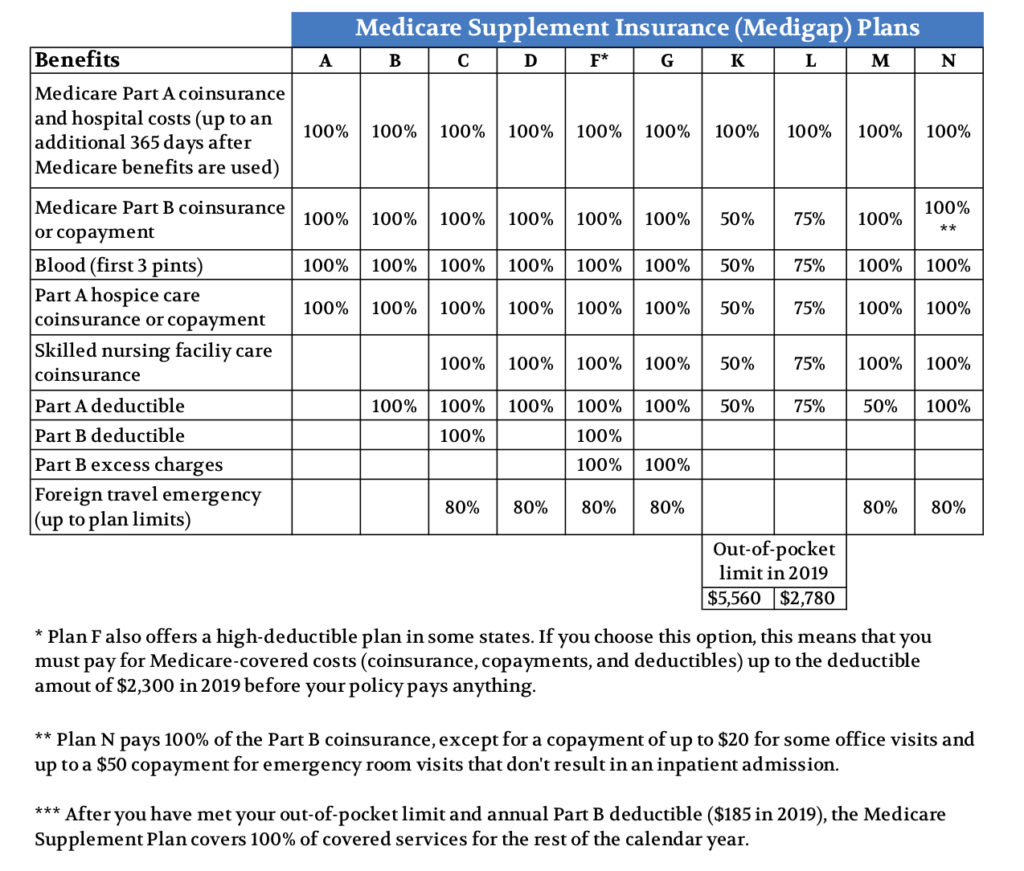

A Medicare Supplement works the same as Original Medicare, as long as the doctor or hospital accepts Medicare they will file a Medicare Supplement plan; It doesn’t matter which letter Medicare Supplement Plan you carry or which company you carry it with. Below is a chart of the different Medicare Supplement plans, current as of 2019.

Foreign Travel with Original Medicare & Medicare Supplement Plan

Medicare Supplement Plans C, D, F, G, M, and N each cover foreign travel. These plans will cover medically-necessary emergency care services beginning during the first 60 days of a trip outside the USA. You pay the first $250 each calendar year then the Medicare Supplement policy will pay 80% up to a lifetime maximum of $50,000. You would pay the other 20% and amounts over $50,000 lifetime maximum.

How does a Medicare Advantage Plan work if I travel?

If you have chosen to receive your Medicare benefits through a Medicare Advantage plan instead of Original Medicare, travel benefits will depend on the plan you are on.

There are a few different types of Medicare Advantage Plans. Here I will explain three of the most common types of Medicare Advantage plans and how they work – HMO (Health Maintenance Organization), HMO-POS (Point of service), and PPO (Preferred Provider Organization).

With an HMO plan you have a provider network you must use for routine care.

With an HMO-POS plan you have a provider network you must use; however, you may be allowed to go out-of-network. Any out-of-network care you receive you may pay more for and those costs may not count towards the plans Maximum Out-of-Pocket Limit (MOOP).

With a PPO plan you will have more flexibility in that you can see providers that are in network and also out-of-network. However, you will likely pay more for out-of-network healthcare. Further, you may need to get a referral to use an out-of-network provider.

All Medicare Advantage plans provide coverage for emergency care, even if you are outside your plan’s service area.

Some Medicare Advantage plans offer travel benefits where if you travel to a county in another state where their plan coordinates, you can use the network there in that other state and be charged the plan’s In Network rates.

Foreign Travel with a Medicare Advantage Plan

All Medicare Advantage plans must cover at least the same level of coverage as Original Medicare. So you would be covered in the same limited situations shown above listed under Foreign Travel with Original Medicare. Some Medicare Advantage plans, however, may provide some additional coverage when traveling outside the U.S.

What else is good to know?

Medicare drug plans don’t cover prescription drugs you buy outside the U.S. If you travel for an extended period of time, for example 6 weeks, be sure to plan accordingly for any medication refills.