Original Medicare contains Part A and Part B. Below is what you would be responsible for if you had only Part A & Part B.

Part A is Hospital Insurance

Part A is designed to cover costs associated with inpatient Medical treatment including hospital inpatient care, care at a skilled nursing facility, hospice, and home health care.

Inpatient Hospital Deductible for 2024

- $1,662 deductible for each benefit period (60 day benefit period)

- Days 1 – 60 = $0 copay after deductible

- Days 61 – 90 = $408 copay per day

- Days 91 and beyond = $816 copay per each “lifetime reserve day” after 90 each benefit period

- There are up to 60 lifetime reserve days in your lifetime.

Skilled Nursing Facility for 2024

- Days 1 – 20 = $0 copay

- Days 21 – 100 = $204 copay per day

- Note: Medicare only pays for a Skilled Nursing Facility if you have had experienced an inpatient hospitalization stay for at least 3 consecutive days prior.

- After day 100 you are responsible for all charges

Hospice Care for 2024 has $0 copay

Home Health Care for 2024 has $0 copay

- Note: Medicare does not cover 24 hour care at home or custodial care, which is help with activities of daily living.

Is there a cost to have Part A?

No charge to simply carry Part A if you paid into Medicare or married to someone who has paid Medicare taxes while working.

Part B is Medical Insurance

Part B is designed to help cover costs of outpatient medical services. There are many services covered by Part B. Below are common items.

Part B covered services include (but not limited to):

- Doctor office visits

- Outpatient surgeries

- Outpatient therapy (physical therapy, occupational therapy, and more)

- Durable medical equipment

Annual Deductible for 2024 = $240

Medical & Other Services you pay 20% of the Medicare-approved amount.

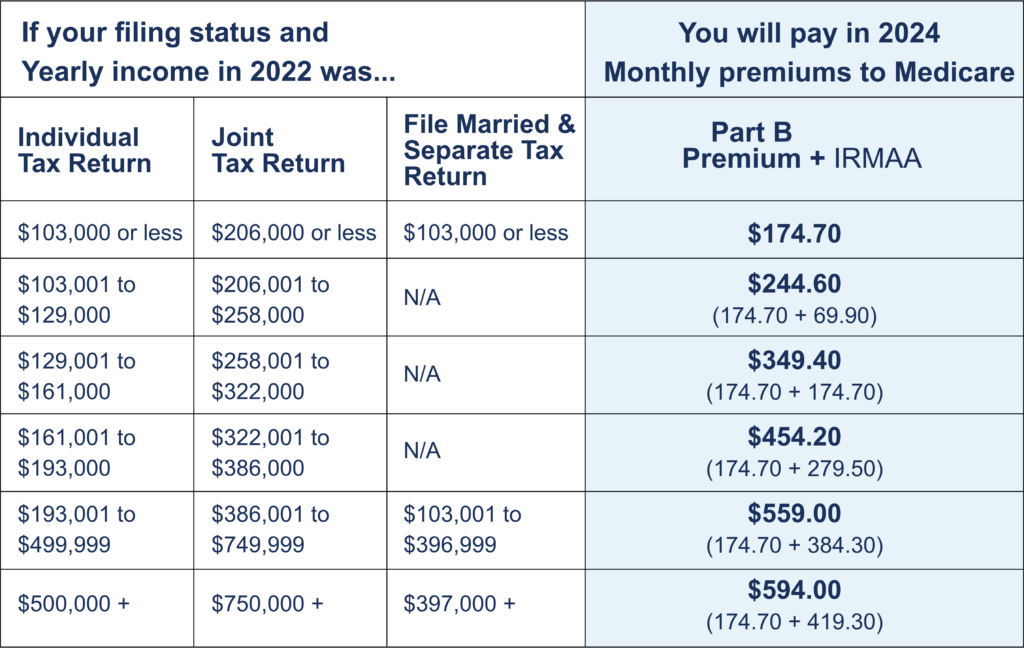

Premiums for Part B:

In 2024, the base premium to carry Part B is $174.70 monthly per individual.

- Depending on your income limit, there may be assistance available to help pay the Part B premium.

- You may pay more due to what is known as the income-related monthly adjustment amount (IRMAA). Your IRMAA surcharge is based on your modified adjusted gross income reported on your federal tax return from two years ago. See chart below.

- If you have a qualifying life changing event and your income is currently lower than the reporting from 2 years ago, you can appeal the surcharge.

Is there a maximum out-of-pocket limit with Original Medicare?

There is no limit to how much medical bills can add to over a calendar year with Original Medicare- it is smart to choose a Medicare Supplement or a Medicare Advantage Plan.

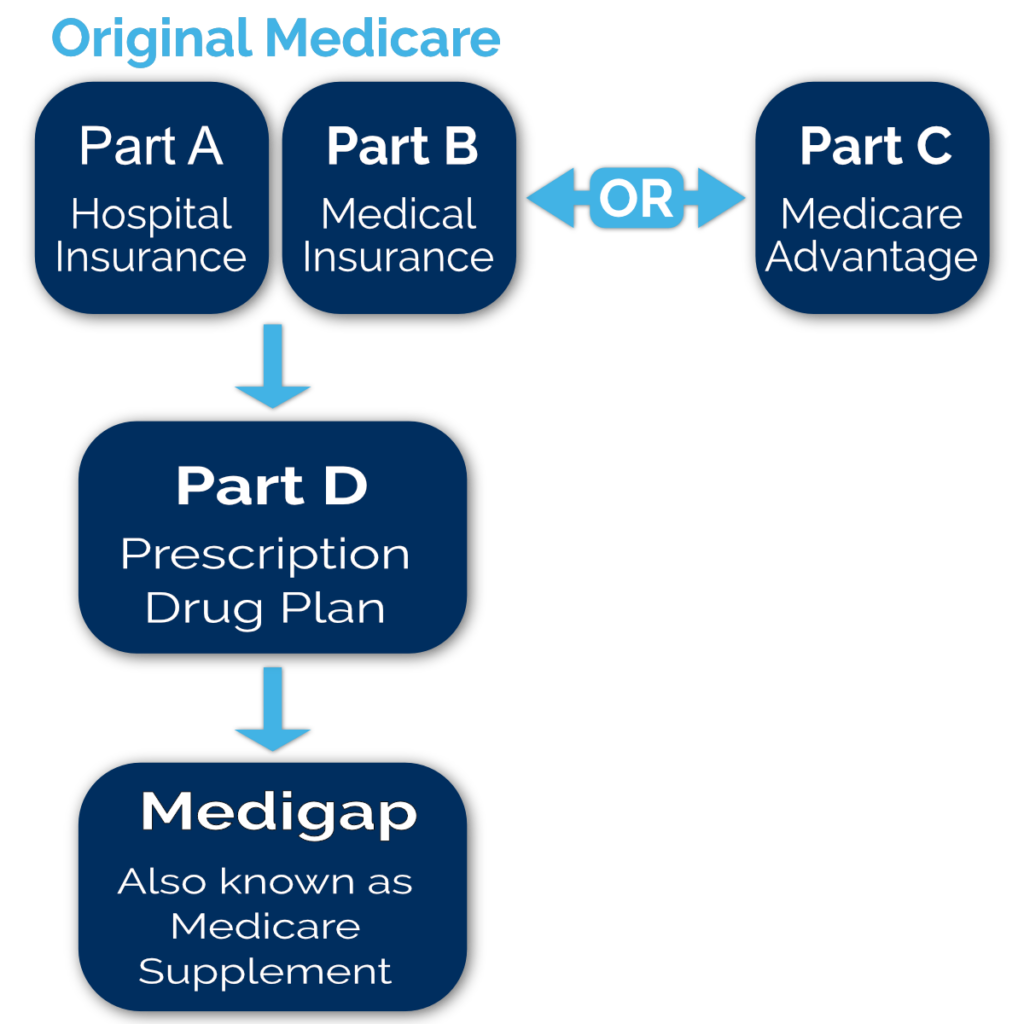

Two Paths to Receiving Coverage