Medicare Supplement plans are also referred to as Medigap plans.

Medicare Supplement plans are designed to cover remaining out of pocket costs not covered by Original Medicare – deductibles and coinsurance.

With a Medicare Supplement plan there are advantages to know about including:

- Freedom to choose any doctor or hospital that accepts Medicare – there is no network

- Use anywhere in the United States

- Some plans have foreign travel coverage

- No referrals necessary to see a specialist

- Predictable out-of-pocket expenses

- Portable if you move

- Guaranteed renewability – the insurance company can never drop you due to a health condition

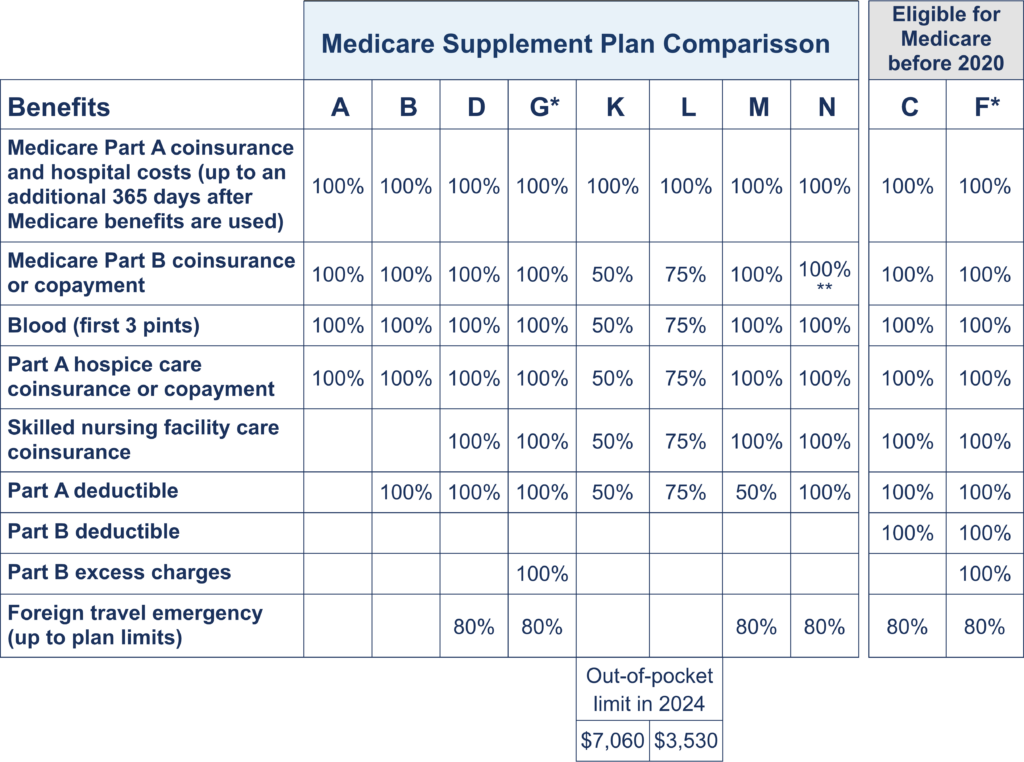

Below is a chart showing the different types of Medicare Supplement Plans available.

The Medicare Part B annual deductible amount for 2024 is $240.

Medicare Supplement plans in Minnesota, Massachusetts, and Wisconsin are charted differently.

*Plan F and Plan G also offer a has a high-deductible plan. If you choose this option, this means that you must pay for Medicare-covered services (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 in 2024 before the plan pays anything.

**Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

Plan C and Plan F are no longer available to individuals that are first eligible for Medicare after January 1, 2020. Individuals that were eligible for Medicare before January 1, 2020 can still enroll in a Plan F or Plan C.

Other Tips to Know:

- You must have Medicare Part A & Part B in order to have a Medicare Supplement plan.

- All Medicare Supplement plans are standardized, meaning every insurance company that offers a plan of a specific letter must offer the exact same standard benefits as another insurance company offering a plan of the same letter. I can provide the premium rates to plans in your area and determine which company to choose.

- Medicare Supplement plans do not include Part D prescription drug plan coverage – a separate plan is needed. See Part D.

- You can review and make changes to Medicare Supplement plans at any time.

- You cannot be asked any medical questions to obtain a Medicare Supplement plan with in the first 6 months of starting Medicare Part B – this is called your Medigap Open Enrollment Period.