Part D plans help in covering some of the cost for medications you get at the pharmacy. Coverage for Part D is provided through a standalone plan or through a Medicare Advantage plan.

Each Part D plan has a formulary, which is a list of medications covered by the plan. Medications can be covered by one plan but not another.

Medication copays are determined by Tiers

- Tier 1 Preferred Generic – Medications in this tier will be lowest cost

- Tier 2 Generic

- Tier 3 Preferred Brand

- Tier 4 Non-Preferred Brand

- Tier 5 Speciality – Medications in this tier will be the most costly

- Tiers are not standardized and can be different from plan to plan. Plans change from year to year. Due to this, it is advised to review annually.

Is assistance available to help with prescription costs?

Yes, Extra Help (also known as a Low Income Subsidy) is a program available to those with limited income and resources to pay for prescription costs. Anyone can apply for this through Social Security. Those who qualify could receive assistance with Part D premiums, deductible, and copayments for covered medications.

What service do I provide on Part D?

I simplify the comparison of Part D plans by determining which is most suitable for you by ensuring your medications are covered at the lowest total overall cost to you. Part D plan premiums vary- the cheapest Part D plan may not be the most suitable as medication copays could be very high.

Other Tips to Know:

- Part D is optional, however, if you go more than 63 days without Part D or other creditable prescription coverage you will be assessed a Late Enrollment Penalty that is added to the monthly premium for the plan you are on and never goes away as long as you have Part D coverage.

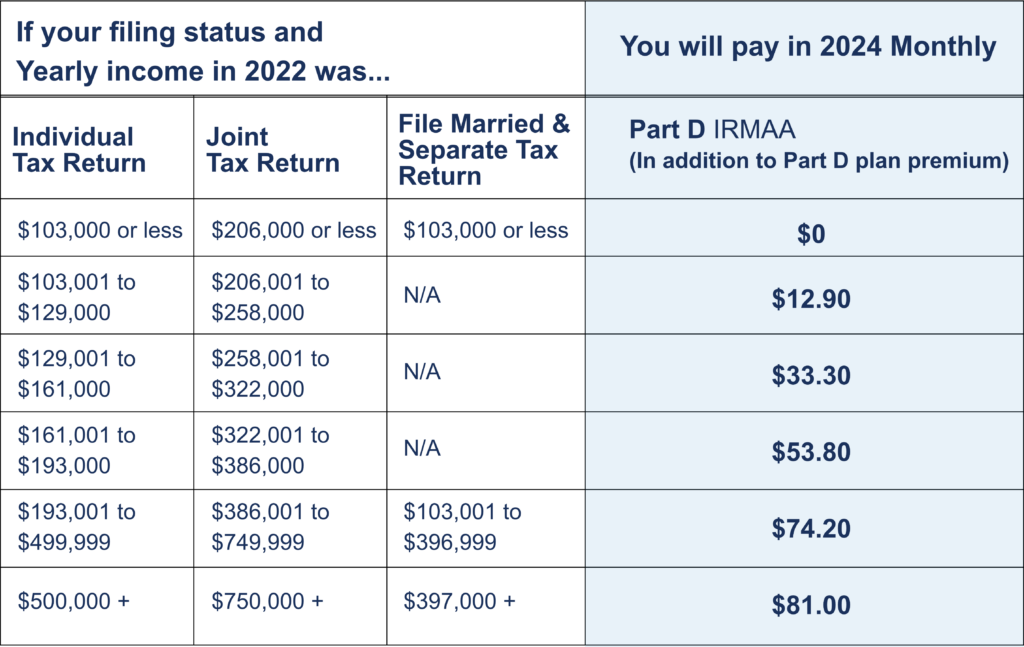

- In addition to a Part D plan premium you may pay an additional amount due to what is known as the income-related monthly adjustment amount (IRMAA). Your Part D IRMAA surcharge is based on your modified adjusted gross income reported on your federal tax return from two years ago. See chart below.

Enrollment Periods for Part D

- You can enroll in a Part D plan within a 7-month period that is 3 months before your 65th birthday and ends 3 months after your 65th birthday.

- If you have delayed starting Medicare Part B (due to having other creditable coverage), you can enroll in a Part D plan within 3 months of starting Part B.

- Annual Enrollment Period, which is from October 15th thru December 7th. The plan chosen during this enrollment period would start January 1st.

- Special Election Period is another option and covers several situations that are unique. Some of these include moving outside your Part D plan service area or being eligible for or losing Medicaid. There are many other special election periods, contact to learn more.