Are you starting Medicare Part B and not age 65? Click here

When to Enroll in Medicare

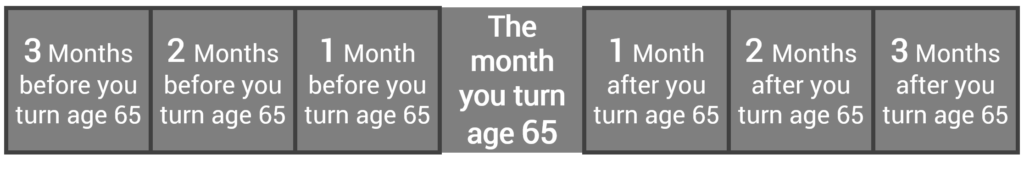

This is the Initial Enrollment Period that is a 7 month period where you can enroll 3 months before you turn age 65, including the month of your birthday, and 3 months after you turn age 65.

When to Enroll in a Medicare Supplement Plan

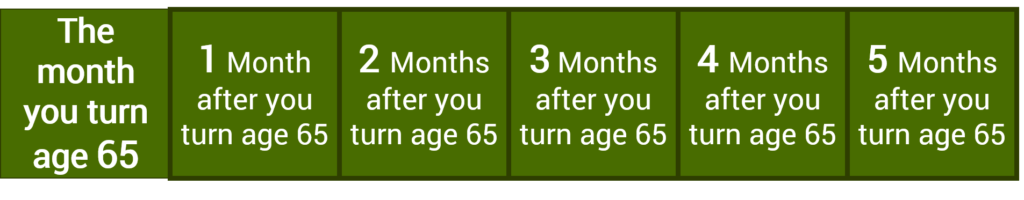

When you are new to Medicare you can enroll in a Medicare Supplement plan during your Medicare Supplement Open Enrollment Period which is a 6 month period. our Medicare Supplement Open Enrollment Period starts the month your Medicare Part B is effective and ends 5 months after. During this 6 month period you cannot be asked any health questions to enroll in any plan. After this 6 month period you still have options to enroll in a plan, however can be asked health questions.

Choosing a Medicare Supplement Plan

There are ten different types of plans to choose from which are shown in the chart below. Senior Savings Services works with you to determine which plan will be best for you. With a Medicare supplement plan you can go to any doctor or hospital that accepts Medicare.

When to Enroll in a Prescription Drug Plan

You can enroll in a Prescription Drug Plan within the 7 month period – 3 months before you turn age 65, including the month of your birthday, and 3 months after you turn age 65.

It is important to know that Medicare Supplement plans are offered by several companies. The 2017 Medicare & You handbook shows on page 81 that all Medicare Supplement plans are exactly the same. As a consumer you have a right to know which companies in your situation are the most cost effective. Senior Savings Services will let you know what the options and rates are on the plans and keep you informed. Senior Savings Services is independent and will work for you year after year to always know what options are available to you. The service is always provided at no charge to you and we do what we say we will do. To get a quote on your options call Senior Savings Services or complete the Get a Quote form at the bottom of this page.

When turning age 65 and becoming eligible for Medicare you may have the option of keeping an employer-sponsored insurance plan. If you are still working, it could be to your favor to delay Medicare Part B and obtain when you decide to retire with no penalty.

If you are retired and have an employer-sponsored insurance plan it could be to your benefit to compare against Medicare plans. Senior Savings Services can let you know what your Medicare options are in comparison with your plan’s premium, deductible, copay, coinsurance, and maximum out of pocket limit so you can best decide for yourself. In recent years more and more companies are changing their employer health plans in retirement.

Affordable Care Act Health Plans and Medicare

If you carry an Affordable Care Act health plan and you become eligible for Medicare Part A or Part B you will want to review and enroll in the options on Medicare. You will have to pay a late enrollment penalty if you do not enroll in a Medicare plan when you first become eligible for Medicare. The late enrollment penalty stays with you as long as you have Medicare.

If you keep your Affordable Care Act health plan, from the time you become eligible for Medicare Part A you won’t be able to keep any premium tax credits or savings based off your income.

Call Senior Savings Services at toll-free 1-800-592-0819.